The $49 Resurrection

Can a marriage of necessity between Spirit and Frontier save the low-cost carrier from extinction?

In the sterile, fluorescent-lit amphitheaters of federal courtrooms, the death of a budget airline is rarely a dramatic affair. It is a matter of spreadsheets and “output restrictions,” of seat-mile costs and the dry, academic theories of contestable markets. Yet, as Spirit Airlines hovers in the purgatory of its second bankruptcy within a year, the collapse of its once-certain union with JetBlue feels less like a corporate failure and more like a cautionary tale of regulatory irony.

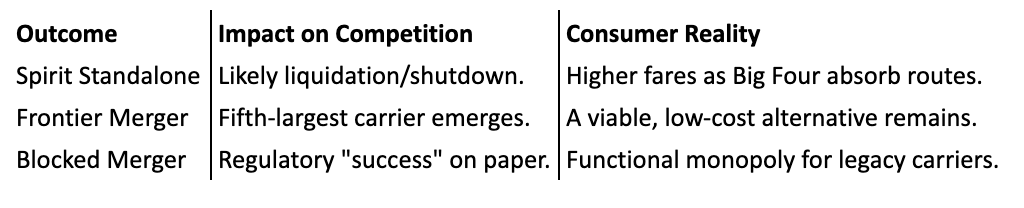

The Department of Justice, in its zeal to protect the “Spirit consumer”—that thrifty traveler willing to endure a 28-inch seat pitch for the price of a mid-range dinner—may have inadvertently orchestrated the very monopoly it sought to prevent. By blocking JetBlue’s $3.8 billion acquisition, regulators aimed to keep a “maverick” alive. Instead, they left Spirit to wither in the sun, a yellow-livered bird with clipped wings, while the “Big Four” carriers—American, Delta, United, and Southwest—watched from their cruising altitudes with quiet satisfaction.

The Mirage of the Maverick

The JetBlue-Spirit merger was always an awkward courtship. JetBlue, with its blue-chip aspirations and “Mint” class prestige, intended to cannibalize Spirit, stripping out its dense seating and raising fares to fund a more civilized experience. The DOJ saw this as a subtraction: fewer seats, higher prices, a net loss for the American public.

But the reality of 2025 has proved more cruel than the regulators’ models. Spirit’s independent path led not to robust competition, but to a “doom loop” of mounting debt and operational paralysis. As it turns out, a “maverick” cannot compete if it cannot afford its fuel. The failure of the JetBlue deal didn’t save Spirit; it merely stripped it of its last best hope for a gilded exit.

A Marriage of Necessity

Now, we see the return of Frontier. If JetBlue was a social climber looking to absorb Spirit’s assets to join the elite, Frontier is a fellow traveler in the trenches. The logic of a Frontier-Spirit merger—resurrected this month amidst Spirit’s desperate search for a debtor-in-possession lifeline—is not one of aspiration, but of survival.

In the New Yorker-esque view of the world, if JetBlue-Spirit was a tragic comedy of manners, Frontier-Spirit is a gritty documentary about the industrialization of the skies.

Scale as a Shield: Alone, both airlines are being crushed by the “Basic Economy” offerings of the legacy carriers—a predatory mimicry where the giants offer low fares to starve the budget upstarts while cross-subsidizing them with corporate contracts.1

The Network Effect: Frontier and Spirit have surprisingly little overlap. A merger would create a national ULCC (Ultra-Low-Cost Carrier) with the heft to actually challenge the Big Four’s dominance in hubs like Orlando, Las Vegas, and Fort Lauderdale.

Cost Synergies: In an era of rising pilot wages and infrastructure costs, two anchors tied together might just find enough buoyancy to float—provided they can navigate the logistical nightmare of merging two of the industry’s most disgruntled workforces.

The Regulatory Paradox

The question for the current administration is whether they will permit a union they once snubbed. If the DOJ blocks a Frontier merger on the same “anti-consolidation” grounds used against JetBlue, they are likely signing Spirit’s death warrant.

A liquidated Spirit is a victory for no one but the incumbents. When a budget airline vanishes, its gates aren’t handed to the next scrappy startup; they are swallowed by the Goliaths. The healthy “airline space” the government desires requires a villain—a bottom-feeder that keeps the others honest.

The Final Approach

We find ourselves in a strange moment where the only way to preserve competition is to allow consolidation. The “Spirit” of the American traveler—the one who just wants to get from Point A to Point B without a second mortgage—now depends on a merger that regulators once viewed with skepticism.

If Frontier is allowed to take the controls, we may lose a brand, but we keep a price point. In the cold, analytical reality of 2025, that is the most “pro-competitive” outcome left on the radar.