Can FIFA 2026 Mend America’s Frayed Welcome Mat?

Beyond the rhetoric, the borders, and the data, this may be America's chance to heal it's relationship with global tourism.

The World Cup—that quadrennial, kinetic spectacle of global communion—will descend upon the United States, along with its neighbors, in 2026. For a nation that still, somewhat quaintly, refers to the sport as “soccer,” the event presents a fascinating, almost allegorical challenge. After years of a pronounced cooling in international visitation, a trend driven by a shifting geopolitical climate and, to be frank, a perceived decrease in American hospitality, the question is not merely if a million visitors will arrive, but what they will find when they do. Will the spectacle of the pitch—a field of emerald possibility—truly be enough to mend the frayed welcome mat of American tourism?

The data suggests a temporary, yet undeniable, surge. Following what analysts at Tourism Economics project to be a challenging 2025—a year anticipated to see a 6.3% decline in international overnight travel to the U.S.—the pendulum is poised for a violent swing. The World Cup is projected to attract an additional 1.24 million international visitors to the U.S. host cities. More tellingly, a significant portion of this is “incremental”—around 742,000 trips that would not have happened otherwise. This is not simply a shuffling of vacation days; it is a profound, if fleeting, cultural importation.

The Concentrated Demand of the Beautiful Game

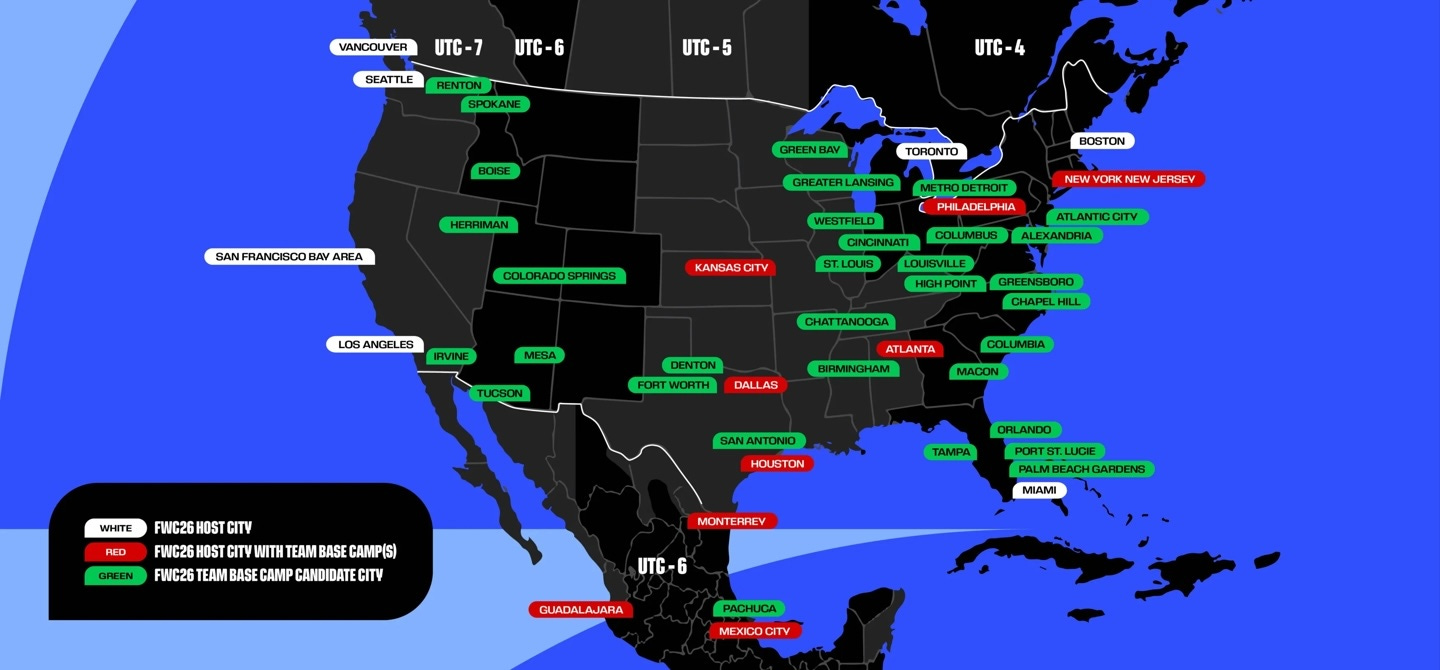

The World Cup is not the Olympics; it is less about a single, monumental host city and more about a kinetic pilgrimage. With 78 matches slated for U.S. cities alone, the demand is an arterial flow, pulsing through New York/New Jersey, Dallas, Miami, and the 11 American locales preparing for their close-up.

The Influx: This visitation is expected to account for nearly one-third of the total growth in U.S. inbound travel in 2026.

The Concentration: The peak is expected in June, with 57 matches, representing a 10% increase in international arrivals for that month alone.

The Revenue: Hotel room revenue in host markets is expected to rise sharply, with increases of between 7% and 25% on peak match days in June. The psychological weight of the final rounds, as history from tournaments past—like Germany in 2006—attests, can see rates soar by nearly 50%.

The sheer, brute-force economics of the event are undeniable. Fans, particularly the dedicated international spectator base, are a high-value commodity. They are estimated to represent roughly 40% of stadium attendance and, critically, they tend to attend multiple matches, often bringing a dozen or more non-ticketed companions per hundred attendees. They don’t just attend a game; they colonize a city for a duration, filling hotels and restaurants.

A Geopolitical Interlude

Yet, to simply chart the revenue is to miss the profound cultural transaction at play. The United States, a land of logistical might, has found itself grappling with an unexpected hurdle in recent years: a sentiment of insularity. The World Cup, in its massive, chaotic, and joyful arrival, forces an administrative and psychological détente.

Recognizing the scale of the required welcome, the U.S. has already moved to offer expedited visa appointments for ticket holders—a rare administrative streamlining that cuts through the bureaucratic friction that has quietly discouraged tourism. This is the central, exquisite tension: a multi-billion dollar cultural event forcing a temporary—and highly profitable—reprioritization of border policy. It is a tacit acknowledgment that, when the economic will is present, the welcome mat can be unrolled with surprising speed.

The Entrepreneurial Scrimmage

The World Cup’s logistical footprint creates a massive, transient market that extends far beyond the stadiums, offering an entrepreneurial scrimmage for local economies. The strain on conventional hotel inventory—with demand in host markets often exceeding available rooms by factors of 2x to 4x on match days—presents an unprecedented opportunity for the short-term rental market. Hotels, and Airbnbs will naturally gather attention.

Truly the weight falls upon the new and fresh ideas. Up and coming home sharing platforms like BLCK (pronounced Block, featured in ep. 304) will become critical arteries, not just for lodging, but for cultural exchange, allowing local homeowners to directly capitalize on the event.

Beyond accommodation, the need for personalized transportation, specialized multilingual tour services, and pop-up food and beverage concepts targeting diverse international tastes (think bespoke viewing parties or dedicated national fan zones) opens the door for hyper-local, travel-centered businesses.

This is a chance for residents not merely to serve as hosts, but as temporary, nimble entrepreneurs, transforming their homes and skills into high-demand, short-lived assets that absorb the massive, concentrated spending power of the global soccer pilgrimage.

The Lingering Legacy of the Fan

The true artistry of the World Cup’s impact, however, lies in its post-script. Will the memory of a summer spent discovering the barbecue of Kansas City, the urban sprawl of Los Angeles, and the manic energy of a New York final, translate into a long-term, structural revival of American tourism?

The data is a bit more ambiguous, yet optimistic. Mega-events provide a sort of global, high-definition branding for host cities. Fans, following multi-city itineraries, are tourists by necessity, stumbling into neighborhoods and cultural sites they would otherwise ignore. The hope is that the first visit, driven by the lure of the game, will create an “indelible mark” that encourages repeat visits in the calmer years that follow.

The challenge for the U.S. is not to merely count the bodies that arrive in June 2026, but to win their hearts. The World Cup is a momentary, global firehose of humanity, forced by the fixture list to engage with America at large. If the host cities can transcend the logistics of the stadium and truly offer a welcoming, open, and accessible cultural experience, then the numbers—the 1.24 million, the 742,000 new travelers—may only be the beginning. Otherwise, it will merely be a magnificent, lucrative six-week interlude, a brief, beautiful exception to a trend of growing distance.

The true revival of American tourism lies not in the tournament itself, but in the echoes of enthusiasm left behind when the final whistle blows.